The Professional Indemnity Policy indemnifies the professional, organization or the company against losses arising from any claim or claims made against them jointly or severally during the period of insurance by acts such as professional negligence, errors or omissions, breaches of professional duties or conduct. The Policy is to protect against liabilities and legal costs assumed by Professionals whiles serving their clients. It is to protect the professional from personal losses if sued or legally held liable for acts which may have caused loss, damage, injury and/or death.

This policy indemnifies the insured against compensation to third parties who may suffer accidental bodily injury, death, and or damage to their properties as a result of the company’s operations.

This policy covers the insured business against legal damages as a result of bodily injury, illness or death to a person caused by any defect to a product sold or supplied.

This policy provides compensation to employee(s) of the insured company for accidental death or bodily injury or illness which occurred in the course of and in connection with such person’s employment.

This policy provides coverage for property damage and third-party injury or damage claims. It also provides coverage for damage to the project under construction and for materials and equipment that are destined for incorporation into the project.

This policy provides cover for risk of loss arising out of the erection and installation of machinery, plant and steel structures, including physical damage to the contract works, equipment and machinery, and liability for third-party bodily injury or property damage arising out of these operations

Apart from specific exclusions, this policy covers all sudden and unforeseen physical losses of electronic equipment of the insured.

This policy provides cover for the insured’s machinery and equipment against physical loss or damage caused by fire, flood, theft and other accidental damage.

This policy provides covers for the insured’s goods/property for any loss or damage while in transit.

This policy covers accidental loss or damage to the insured vessel and third party liability.

While Fire Policy provides cover for damage and losses of/to the insured property caused by fire the All Risk policy provides cover for the insured property that is accidentally physically lost, destroyed or damaged by anything other than the excluded causes.

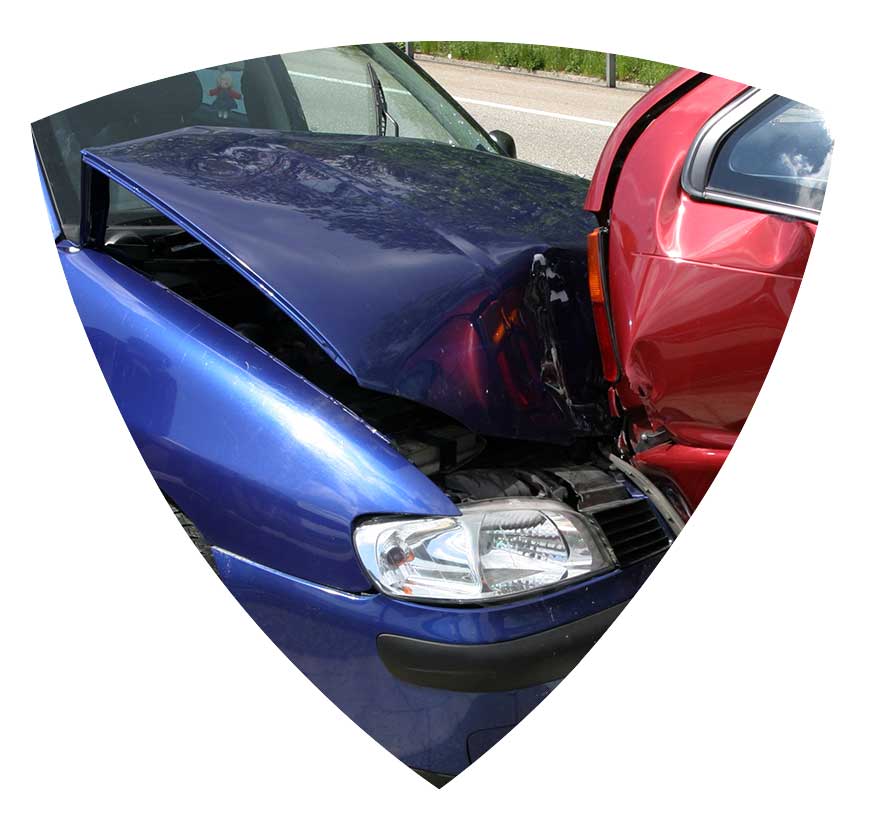

Third Party Motor Insurance Cover is compulsory per the Motor Vehicle (Third Party) Insurance Act, (1958). This policy indemnifies the insured against claims by third parties for death, injuries or damage to their properties. The insurer’s liability however is limited to the Third Party Property Damage limit stated.

In addition to protection against claims by third parties for death, injuries or damage to their properties, this policy also covers damage to the insured vehicle caused by fire.

Comprehensive Policy

Comprehensive motor insurance covers partial or total damage of the insured vehicle.

This policy covers specific losses, travel delays and sudden ill health expenses. Tailor made policies are also available for Groups

This policy indemnifies the insured against compensation to third parties who may suffer accidental bodily injury, death, and or damage to their properties as a result of the company’s operations.

This policy indemnifies the insured against compensation to third parties who may suffer accidental bodily injury, death, and or damage to their properties as a result of the company’s operations.

This policy provides compensation to employee(s) of the insured company for accidental death or bodily injury or illness which occurred in the course of and in connection with such person’s employment.

This policy provides coverage for property damage and third-party injury or damage claims. It also provides coverage for damage to the project under construction and for materials and equipment that are destined for incorporation into the project.

This policy provides cover for risk of loss arising out of the erection and installation of machinery, plant and steel structures, including physical damage to the contract works, equipment and machinery, and liability for third-party bodily injury or property damage arising out of these operations

This policy provides cover for risk of loss arising out of the erection and installation of machinery, plant and steel structures, including physical damage to the contract works, equipment and machinery, and liability for third-party bodily injury or property damage arising out of these operations

Motor Insurance Policy

A broker’s job is to help you to identify the risks that you or your business may be exposed to.

The broker will advise you on what insurance’s are available for these risks and will canvas the wholesale business insurance market to obtain the most advantageous terms for these covers providing you with the insurance quotes.

The broker will then discuss this with you and when agreed place the cover with the chosen insurer/s and arrange the documentation at the specified insurance rates.

The broker will also help you with general insurance advice and information as required and look after any amendments to the policies that may be required. With any claims, the broker will assist you in formulating the claim and will liaise between you and the insurer to bring the claim to a successful resolution.

Brokers identify companies in which they have confidence and whom they are able to develop a working relationship.

Their primary goal is to consider product, service and price in order to make the best possible recommendation to their clients so that their clients can make informed decisions about their insurance protection.

The recommendation brokers make is based solely on the attributes of the insurance product or service and the needs of their clients.

The first step in determining the answer to this question is to work with your broker to identify and define the areas of risk for you or your business. The decision then is which risks to retain (i.e., not insure) and which risks to transfer through insurance.

The sums insured should be relevant to the risk, taking special care not to under-insure and be subjected to co-insurance clauses. To choose to take the risk yourself to save money can leave you vulnerable and may severely affect your cash flow or assets. This is where our experience can assist you in making decisions on how much insurance you require to adequately cover your various risks.